Health Savings Accounts

What is a Health Savings Account (HSA)?

Health Savings Accounts are tax-advantaged savings accounts that are used in combination with a High Deductible Health Plan (HDHP) offering consumers a new way to manage their healthcare. Consumers use the HSA to cover qualified medical expenses. The HSA account can also function as an additional retirement plan.

HSA’s can be funded by both employer and employee dollars and are portable allowing the accounts to follow the employee if they change employment status. HSA’s are also funded by the calendar year from January 1st through December 31st and not by the medical plan year.

HSA’s offer consumers triple tax savings!

- Federal tax deductions on contributions

- Tax-free growth on invested funds

- Tax-free withdrawals for qualified medical expenses

At AdminUSA, delivering easy-to-use solutions backed by the highest levels of service is our top priority. We offer a Software-as-a-Service solution, designed to provide employers, employees, and brokers with functionality, reliability and integration needed to offer worry-free Consumer Driven Health Care accounts. And, you can be assured we’ll support you with the highest levels of IT expertise and regular additions of new, productivity-enhancing features.

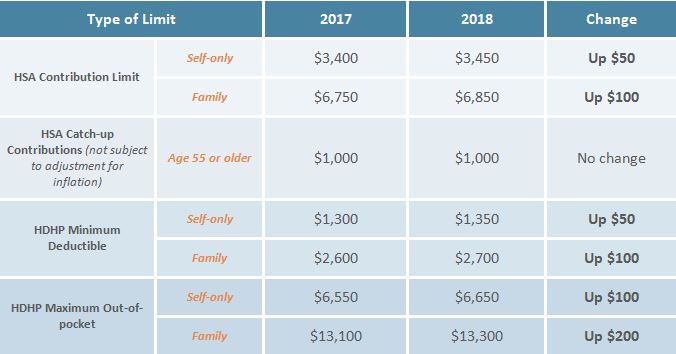

HSA Limits

The maximum HSA contribution for 2012 for individuals will be $3,100 and individuals with family will be $6,250. The HSA must be combined with a High Deductable Health Plan. The high deductible health plan for 2012 for the individual must have the annual deductible of at least $1,200 for self-coverage or $2,400 for family coverage. The annual out-of-pocket maximum amount cannot exceed $6,050 for self-only coverage and $12,100 for family coverage. Out of pocket expenses include deductibles, co-payments, and other qualified medical expenses. Out-of-pocket expenses do not include premiums.

The following chart shows the health savings account (HSA) limits that apply for 2018. It also shows the limits that applied for 2017 for purposes of comparing the annual limits. The IRS limits for HSA contributions and high deductible health plan (HDHP) cost-sharing all increased for 2018